Get ₹10,000 Loan on Aadhar Card Online in Minutes

Apply for a ₹10,000 loan using your Aadhar card. Secure a 10,000 loan with aadhar through Creditt+ with a fast approval process, offering numerous benefits.

₹10,000 Loan on Aadhar Card

Do you need an emergency loan of ₹10,000 on Aadhar card or in need of fast money? Now it has never been simpler to obtain an emergency loan of ₹10,000 with Aadhaar cards as the primary document to make loans easily accessible!

Hefty medical bills, urgent personal Quick Loans or any other expenditure; the borrowed payment based on Aadhar helps cover them all!

Creditt+ will lead you step by step for taking the facility of an online Aadhar Card Loan of ₹10,000 while sharing benefits, eligibility, and the complete step-by-step process for availing the loan.

Rapid Approval

Since Aadhar cards are issued by the government, using one streamlines the loan application process and enables quick approval.

No Collateral Required

Unsecured loans do not require collateral as security against repayment.

Repayment options

Easier and more affordable than ever that make taking a loan simple and straightforward!

Instant Disbursal

Loan amount gets directly credited to your bank account within hours, all online and without having to visit any branch or wait in queue.

Minimal Documentation

Minimal documentation such as your Aadhar card, basic proof of earning, etc., need to be provided.

Self-employed individuals are not eligible

Between 18 and 55 years old

Full-time salaried only

Minimum Monthly Salary of INR 20,000

At least 3 months in current or recent employment

A minimum Credit Score of 680.

Eligibility Criteria for Personal Loan on ₹20,000 Salary

Credit+ keeps eligibility conditions simple so you can quickly assess whether the personal loan for 20,000 salary is suitable before applying. This supports responsible lending and smoother approvals.

Need a bit of quick cash, like Loans for Travel ? Once you satisfy the basic criteria, your chances of online approval for an Aadhar card loan of ₹10,000 is extremely likely.

Required documents - Your path to financial freedom

Application form

Aadhar Card

Salary statement of 90 days

Recent Selfie

Interest Rate and Applicable Charges for Aadhar Card Loan

Typically, annualized rates could be determined mainly by the principal amount, duration and income. Here are some additional expenses. Checking all terms and conditions when making decisions to get 10000 loan on aadhar card can help avoid unexpected charges or fees that might otherwise arise. One benefit of getting personal loans with Creditt+ is that there are no pre-payment charges

Processing fees

A minimal processing fee is usually levied on your loaned amount.

Late Payment Penalties

It will be levied on delayed payments

How to Apply for Personal Loan at Low Interest?

Applying for a personal loan with Creditt+ is a seamless digital experience—not a drawn-out financial ordeal. Complete your application in minutes and receive approval quickly, without the frustration of endless waiting periods.

Visit the Creditt+ Website or App

Go to the official portal and click on “Apply Now.”

Enter Your Details

Fill in your name, mobile number, income details, and credit score.

Upload Required Documents

Upload your PAN card, Aadhaar card, and last 3 months' bank statement.

One-Time Payment

Repay the full loan amount in a single payment, making the process quick and straightforward.

Prepayment

If you have surplus funds, you can pay off the loan early, reducing the outstanding balance and interest burden.

Auto Debit

Set up auto-debit to ensure timely repayment and avoid missing any payments.

Repayment Options of ₹10,000 Loan on Aadhar Card

Repaying your ₹10,000 loan on Aadhar card online is easy and flexible:

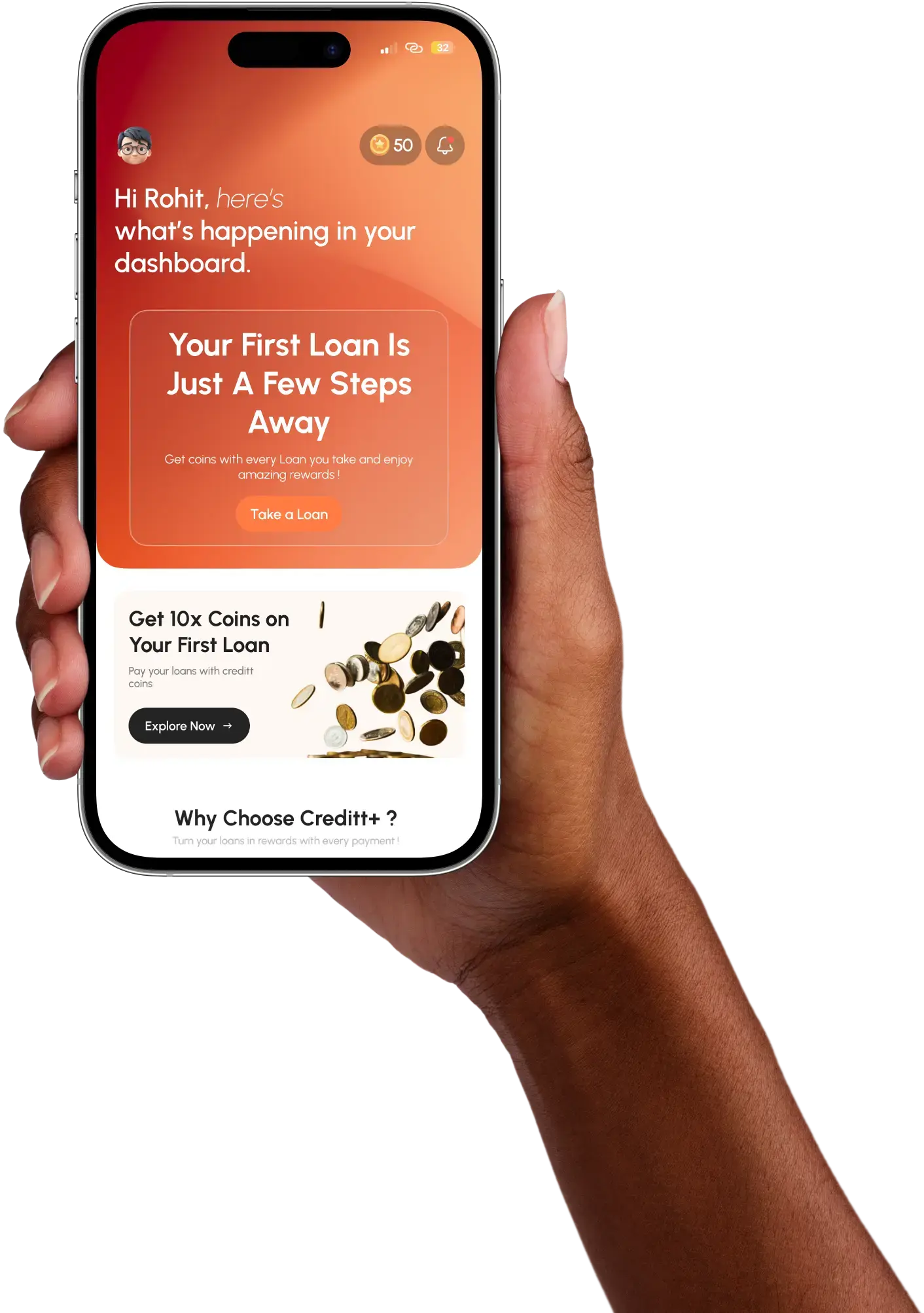

Download our app now!

In just a few steps, you can apply, get approved, and receive your funds instantly—no complicated processes or hidden fees.

Why choose creditt+ for ₹10,000 Loan on Aadhar Card?

There are numerous reasons why Creditt+ is the perfect solution when it comes to Aadhar card loans of this size:

Creditt+ offers fast loan approval and disbursal to meet customers' financial needs efficiently and with minimum paperwork needed - such as Aadhar card number or basic documents required for approval.

Flexible Repayment Terms to suit your income and financial situation

Creditt+ provides its users with competitive interest rates, with full transparency and no hidden charges

Creditt+ offers Secure and Reliable Services by employing top-of-the-line encryption technology, Creditt+ guarantees the protection of your personal information safely.

Need help?

Here are some frequently asked questions. Reach out to us anytime between 10 AM - 7 PM from Monday to Sunday (except national holidays)

+91 22 45811515

customer.support@creditt.in

How to get a Rs. 10,000 loan on an Aadhaar card?

What is the maximum loan amount on an Aadhaar card?

Which apps give a loan on an Aadhaar card?

How to apply for a personal loan on an Aadhaar card without a salary slip?

Why should I take a loan using my Aadhar card?