Apply for ₹30000 Personal Loan Online

Apply for an instant 30000 personal loan with minimum salary of 20,000 at Creditt+. Enjoy quick approval & flexible repayment options today. Apply now!

Apply for ₹30000 Personal Loan Online

Do you need a personal loan of up to ₹30,000? Whether it’s for urgent expenses, home renovations, medical needs, or a special occasion, quick loans can be a lifesaver.

Creditt+ makes it easy to access a ₹30,000 personal loan with fast approval and minimal documentation.

In this guide, we’ll walk you through the features, eligibility criteria, application process, and everything else you need to know to secure an instant personal loan with ease.

Fast Approval

Get your loan approved within hours of submitting your application.

Instant Disbursal

Once you meet the eligibility criteria, the loan amount is directly disbursed to your bank account without delay.

No Hidden Charges

Enjoy complete transparency with no surprises—you’ll know exactly what you’re paying for.

Minimal Documentation

The process is smooth and hassle-free, requiring only a few essential documents.

Low Interest Rate

Benefit from competitive interest rates, making the loan more affordable for you.

Must be an Indian Citizen

Age between 21-55 years

Must be a salaried professional

Minimum Monthly Salary of INR 25,000

Credit score of 650 or above

Are you eligible for ₹30,000 Personal Loan?

To qualify for our loans,

you must meet specific criteria.

Required documents - Your path to financial freedom

Application form

Aadhar Card

Salary statement of 90 days

Recent Selfie

₹30000 Personal Loan Interest Rate and Applicable Charges

When applying for a ₹30,000 personal loan, interest rates and charges are determined based on several factors, including your income, creditworthiness, and loan tenure.

Interest Rate

Rates are competitive and designed to ensure affordability for borrowers.

Processing Fee

A one-time fee is charged for application and approval, clearly disclosed upfront.

Overdue Charges

Penalties may apply for delayed payments, encouraging timely repayment.

Prepayment or Foreclosure Charges

There are no prepayment or foreclosure charges.

Applying for a loan has never been easier

Follow these steps to get started!

Visit the Creditt+ website

Click on Apply Now and fill the application form. Here, all necessary personal details such as name, address, income level, etc need to be entered before uploading your Aadhaar card/income proof/bank statements, etc for review.

Submit Your Application

After providing all the details and uploading the relevant documents, submit your application for review.

After Approval

Upon approval, the loan amount will be disbursed directly into your bank account within a very short while.

Single Payment Option

Repay the entire loan amount, including interest, in one lump sum by the end of the agreed tenure, rather than through monthly EMIs.

₹30000 Personal Loan - Repayment Options

With a ₹30,000 personal loan, repayment is designed to be simple and hassle-free. Here’s how it works:

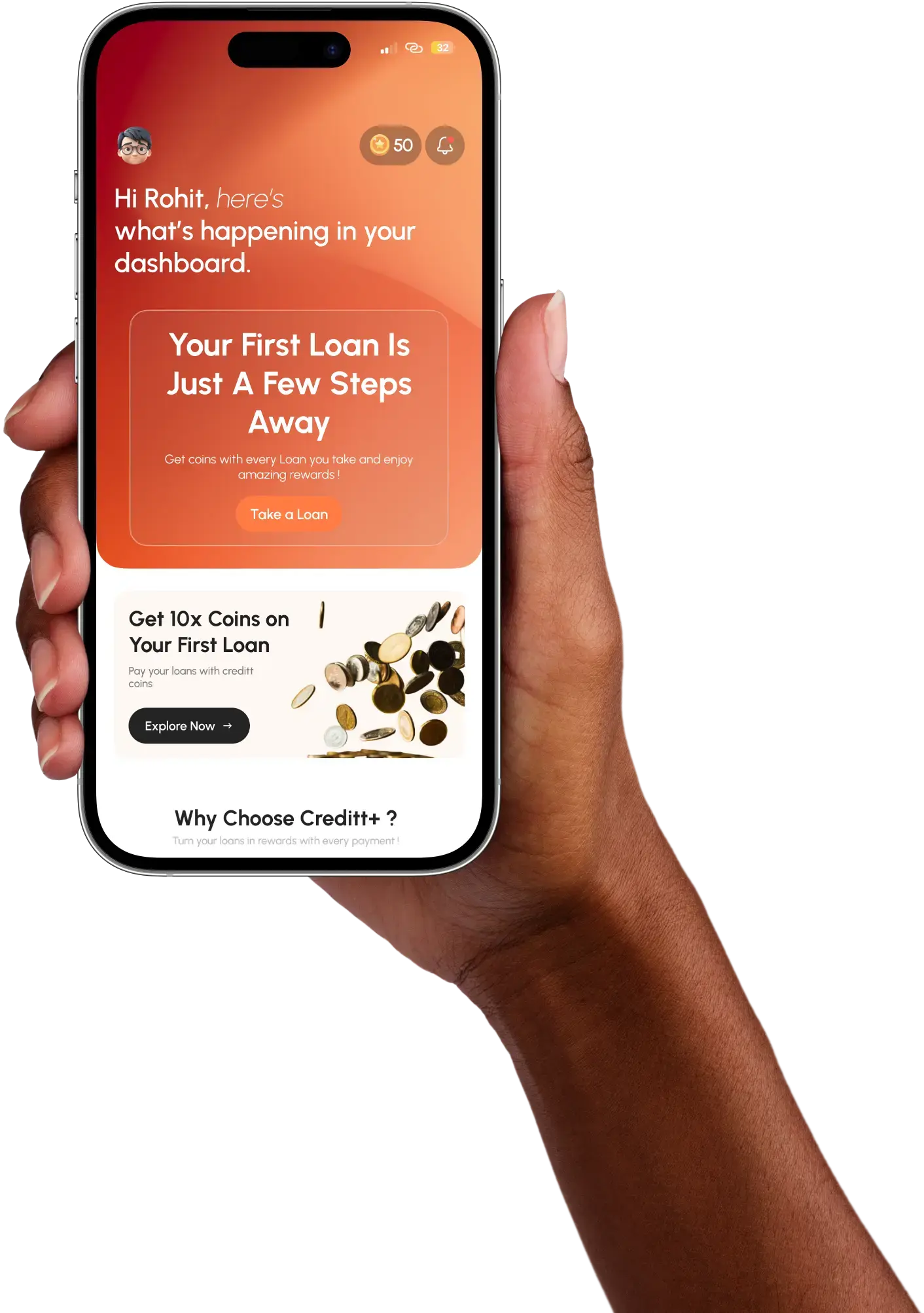

Download our app now!

In just a few steps, you can apply, get approved, and receive your funds instantly—no complicated processes or hidden fees.

Why choose creditt+ for ₹30,000 personal loan?

At Creditt+, our customer-focused approach ensures a seamless experience when applying for a ₹30,000 personal loan. Here’s why we’re the best choice:

Transparent Procedures: No hidden charges and clear, simple terms.

Fast Disbursement: Receive your ₹30,000 instant loan within minutes of approval.

Customized Loan Options: Select a loan plan tailored to your financial needs.

Excellent Customer Support: Our team is available to assist with any queries or concerns from 10 AM to 10 PM, Monday to Saturday. You can also visit our FAQ page for instant solutions to your queries.

Convenient Online Application: Apply anytime, anywhere, with just a few clicks.

Need help?

Here are some frequently asked questions. Reach out to us anytime between 10 AM - 7 PM from Monday to Sunday (except national holidays)

+91 22 45811515

customer.support@creditt.in

Is it possible to get a 30k personal loan?

What is the monthly payment of a 30000 loan?

What is the EMI for a 30000 loan?

Can I Avail ₹30000 Personal Loan Without Documents?

What CIBIL Score is Needed for a Rs. 30000 Personal Loan?